Bitcoin retail traders remain fearful, here’s why BTC could test all-time high

- Bitcoin price remains rangebound under the $100,000 milestone on Thursday.

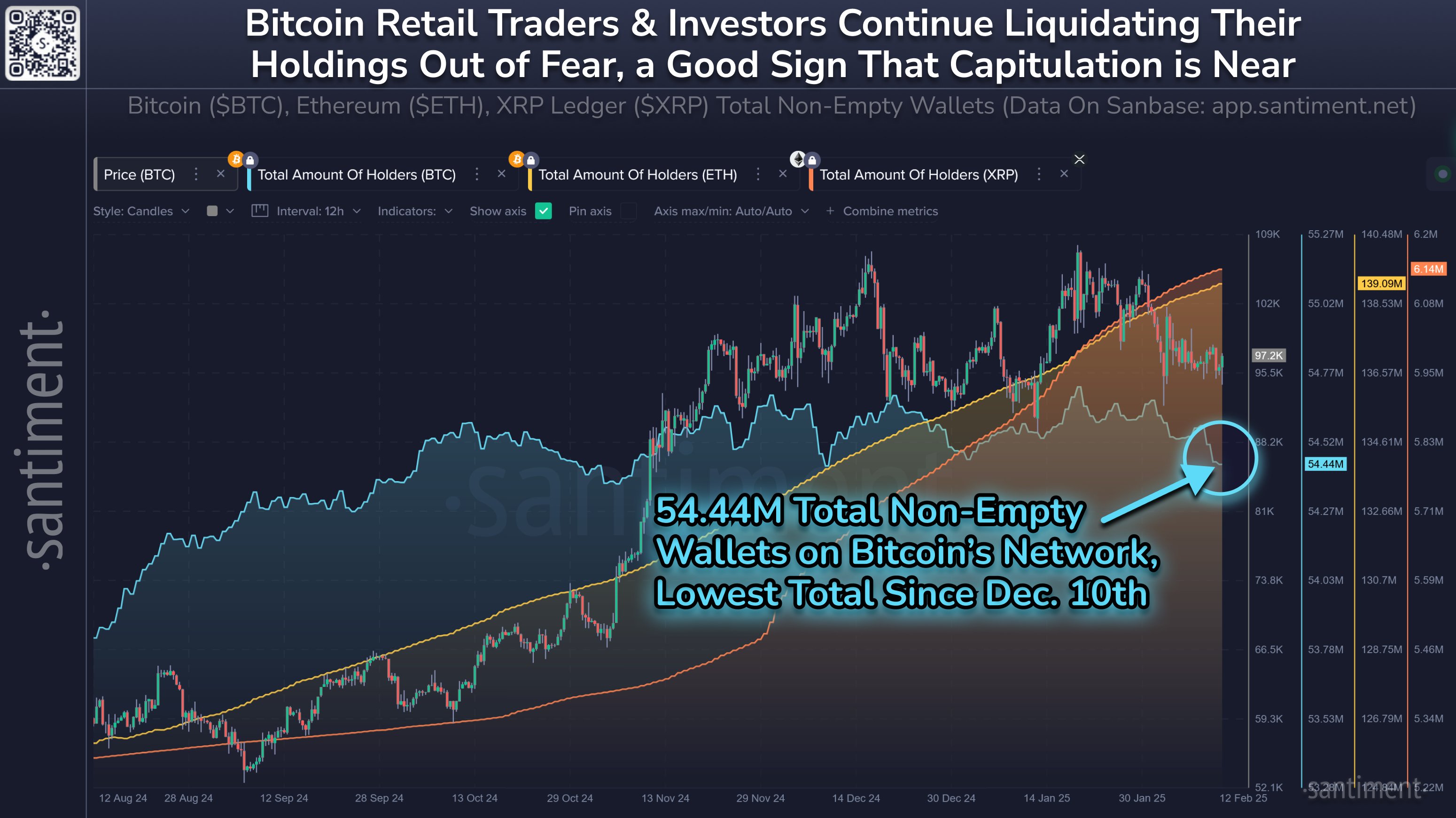

- On-chain data shows retail traders and small investors are likely capitulating out of fear.

- The count of total non-empty wallets on the Bitcoin blockchain has dropped to the lowest level since December 10.

- Imran Lakha of Options Insight believes Bitcoin’s volatility could normalize after key events as traders adapt to range-bound conditions.

Bitcoin (BTC) retail traders and small wallet holders reduce their holdings amidst fear of a steeper correction in the largest cryptocurrency by market capitalization. BTC price consolidates below the $100,000 level on Thursday, erasing less than 2% of its value on the day.

Bitcoin traders are fearful, a positive sign for BTC price

Crypto intelligence platform Santiment notes that Bitcoin now has 277,240 less non-empty wallets than it did three weeks ago. The change in the metric indicates that small wallet holders and retail traders are offloading their BTC, fearful of further decline in the token.

The decline is typically a sign of fear of a market-wide correction in crypto, and as retail belief drops, the token’s mid- to long-term price performance could improve. Santiment’s analysts note that while retail traders and smallholders drop their BTC holdings, whales and sharks (meaning large and institutional holders of Bitcoin) accumulate the coins.

According to historical data, whale accumulation could drive up the price when fear is at its highest level among market participants.

Santiment’s data shows that the total non-empty wallets on Bitcoin’s network have dropped to 54.44 million, the lowest level recorded since December 10.

Bitcoin non-empty wallet count | Source: Santiment

Bitcoin volatility could normalize, rally to new all-time high likely

Realized volatility, a metric that measures the historical volatility of an asset, climbed from mid-40s to mid-50s, according to Imran Lakha of Options Insight. In a YouTube video, Lakha comments on the likelihood of a short-term correction in Bitcoin price, according to options data by Amberdata.

Evaluating the volatility spread in the options market, Lakha expects volatility to normalize by March options expiry. This reinforces the idea that the worst of the “flash crash” may be behind us.

Short-term volatility remains high, however options data confirms a bullish continuation in Bitcoin in the near term.

Technical analysis: Bitcoin trades less than 15% below the all-time high

Bitcoin is hovering around the $96,000 level, less than 15% away from its all-time high of $109,588 reached on January 20. On the daily timeframe, Bitcoin could find support at the $93,572 level, which coincides with the 50-day Exponential Moving Average (EMA).

On the upside, Bitcoin faces resistance at the upper boundary of the Fair Value Gap (FVG) at $103,278, a key level above the $100,000 milestone.

The momentum indicator Moving Average Convergence Divergence (MACD) flashes consecutive red histogram bars, shorter than the previous ones, meaning the negative underlying momentum in Bitcoin’s price trend is waning.