BTC whales buy recent dips

Bitcoin price today: $98,300

- Bitcoin price trades in green on Monday after rallying almost 9% and hitting a new all-time high of $99,588 the previous week.

- Coinglass data shows the recent price drop on Sunday resulted in almost $500 million in total liquidations, more than $80 million specifically in BTC.

- On-chain data paints a bullish picture as US spot Bitcoin ETFs show a $3.34 billion net inflow last week and whales accumulating weekend dips.

Bitcoin (BTC) recovers from its weekend drop and trades higher above the $98,000 level on Monday after rallying almost 9% and hitting a new all-time high (ATH) of $99,588 last week. Coinglass data shows that the recent fall during the weekend wiped out almost $500 million in total liquidations, more than $80 million specifically in BTC. However, on-chain data projects a bullish outlook, as US spot Bitcoin Exchange Traded Funds (ETFs) show a $3.34 billion net inflow last week and whales accumulating weekend dips.

Bitcoin whales and institutional remain strong

Bitcoin price reached a new all-time high of $99,588 on Friday, just $412 away from the $100,000 milestone. However, during the weekend, BTC dipped 3.8%, reaching a low of $95,734 on Sunday, but quickly recovered and closed at $97,900.

BTC’s drop triggered a wave of liquidations across the crypto market, resulting in almost $500 million in total liquidations in the last 24 hours, more than $80 million specifically in BTC, according to data from CoinGlass.

Exchange Liquidations chart. Source: Coinglass

Despite the recent dip in Bitcoin, whales are still accumulating BTC. Lookonchain data shows that six fresh wallets withdrew 1,110 BTC worth $107.7 million from Binance on Sunday. Additionally, Data Nerd data also shows that three wallets accumulated 702.2 BTC worth $68.6 million from Binance on Saturday.

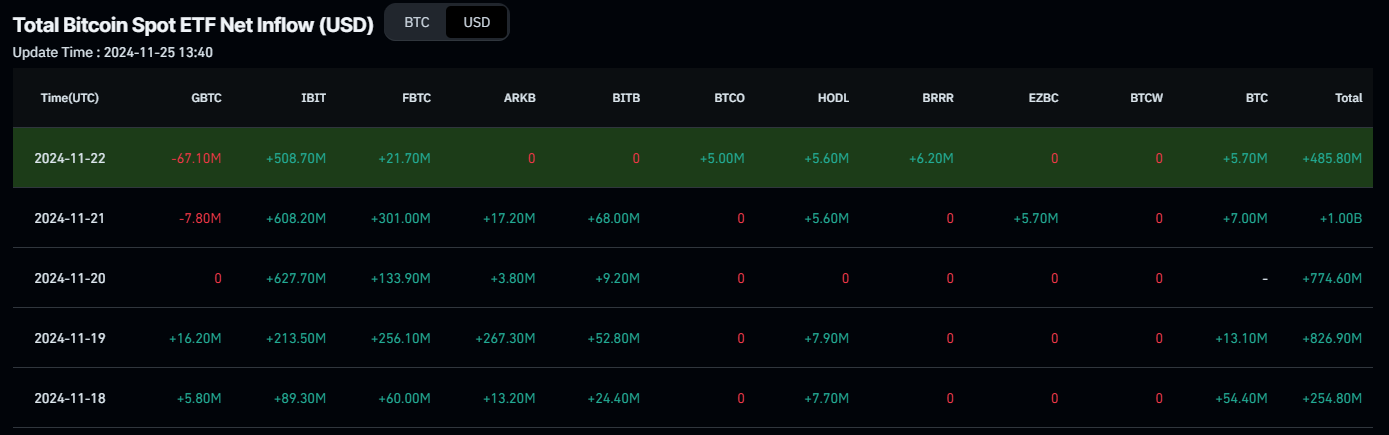

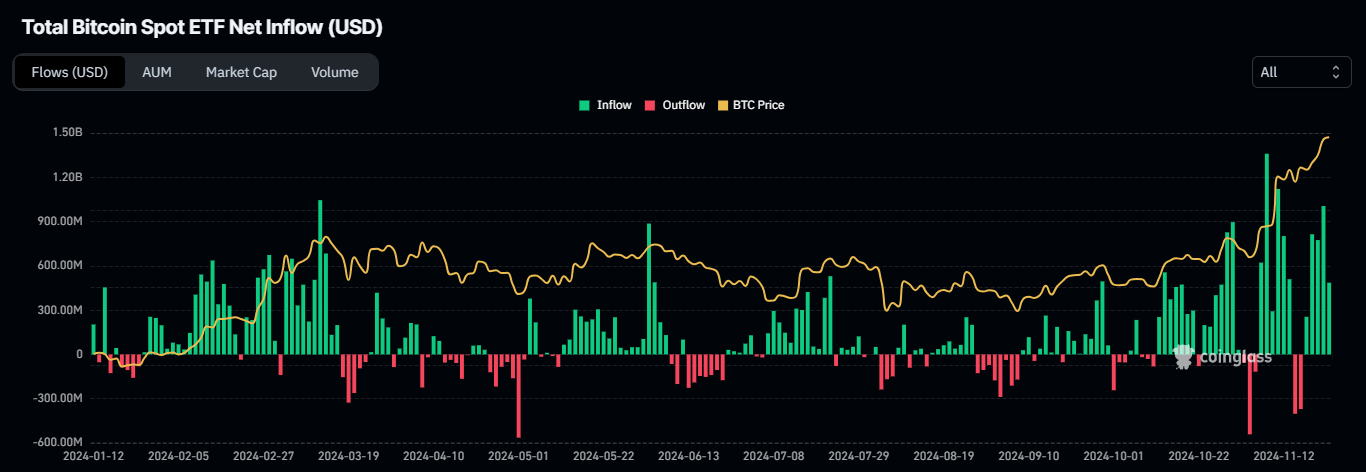

Moreover, institutional flows are also accumulating Bitcoin. According to Coinglass ETF data, US spot Bitcoin ETFs experienced a total net inflow of $3.34 billion last week, compared to $1.78 billion the previous week. If this inflow trend persists or accelerates, it could provide additional momentum to the ongoing Bitcoin price rally.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Traders should remain cautious as Bitcoin (BTC) approaches the $100,000 milestone. Profit-taking is a natural part of any price rally, and early signs of this are already emerging in the ongoing uptrend. According to CryptoQuant, the Short-Term Spent Output Profit Ratio (SOPR) indicator measures profits realized on coins held for more than 1 hour but less than 155 days. For this analysis, short-term investors hold Bitcoin for less than 155 days.

Historically, when using a 30-day moving average to the Short-Term SOPR, it has been observed that during bullish trends, the metric tends to reach around 1.02 before profit-taking occurs. Each time this level has been reached, Bitcoin’s price has experienced a pullback or correction.

On Monday, the metric stands at 1.02, suggesting that Bitcoin’s price could face a short-term correction. However, if capital inflows into the market continue and investors remain eager to buy Bitcoin, this historical pattern could be overridden, leading to a strong breakout beyond $100,000.

-638681354985638772.png)

Bitcoin Short Term Holder chart. Source: CryptoQuant

Bitcoin Price Forecast: Inches from $100,000 milestone

Bitcoin price rallied more than 40% in the last three weeks, hitting a new ATH of $99,588 on Friday. If BTC continues its upward momentum, it could extend the rally to retest the significant psychological level of $100,000.

However, the Relative Strength Index (RSI) momentum indicator stands at 78, signaling overbought conditions and suggesting an increasing risk of a correction. Traders should exercise caution when adding to their long positions, as the RSI’s move out of the overbought territory could provide a clear sign of a pullback.

BTC/USDT daily chart

If Bitcoin faces a pullback, it could decline to retest its key psychological level of $90,000.

В этом году в фэшн-индустрии будут смелые тенденции. Кутюрье делают ставку на природные ткани и необычные силуэты. В палитре доминируют глубокие тона, однако сочные акценты не останутся в стороне. Модные дома сфокусированы на громоздких дополнениях. Актуальны старинные детали и минималистичный подход.

http://www.kaninchenwissen.de/viewtopic.php?t=2478

Exquisite wristwatches have long been a benchmark of excellence. Meticulously designed by legendary watchmakers, they seamlessly blend tradition with modern technology.

Each detail demonstrate exceptional attention to detail, from hand-assembled movements to high-end elements.

Owning a timepiece is more than a way to check the hour. It signifies sophisticated style and heritage craftsmanship.

Be it a minimalist aesthetic, Swiss watches deliver unparalleled reliability that never goes out of style.

http://www.frontenginedragsters.org/forum/index.php/topic,78437.new.html#new

Luxury timepieces have long been a gold standard in horology. Crafted by world-class artisans, they combine heritage with cutting-edge engineering.

Each detail embody exceptional attention to detail, from precision-engineered calibers to premium finishes.

Wearing a timepiece is more than a way to check the hour. It stands for refined taste and exceptional durability.

No matter if you love a bold statement piece, Swiss watches offer extraordinary precision that lasts for generations.

http://marshallplast.com/forum/index.php?topic=81.new#new