ETH falls toward the average cost basis of investors amid Pectra upgrade issues

Ethereum price today: $2,150

- Ethereum MVRV declines below 1, signaling ETH’s retreat to the undervalued region.

- Developers will decide on the timeline for the Pectra mainnet upgrade after the successful recovery of the Holesky testnet.

- ETH risks a further decline to $1,500 if it fails to see a major recovery above $2,200.

Ethereum (ETH) is down 3% on Friday following its decline into the undervalued region and failure to finalize Holesky since running into issues during the testnet’s Pectra upgrade.

Ethereum approaches undervalued region following Pectra’s failure on testnets

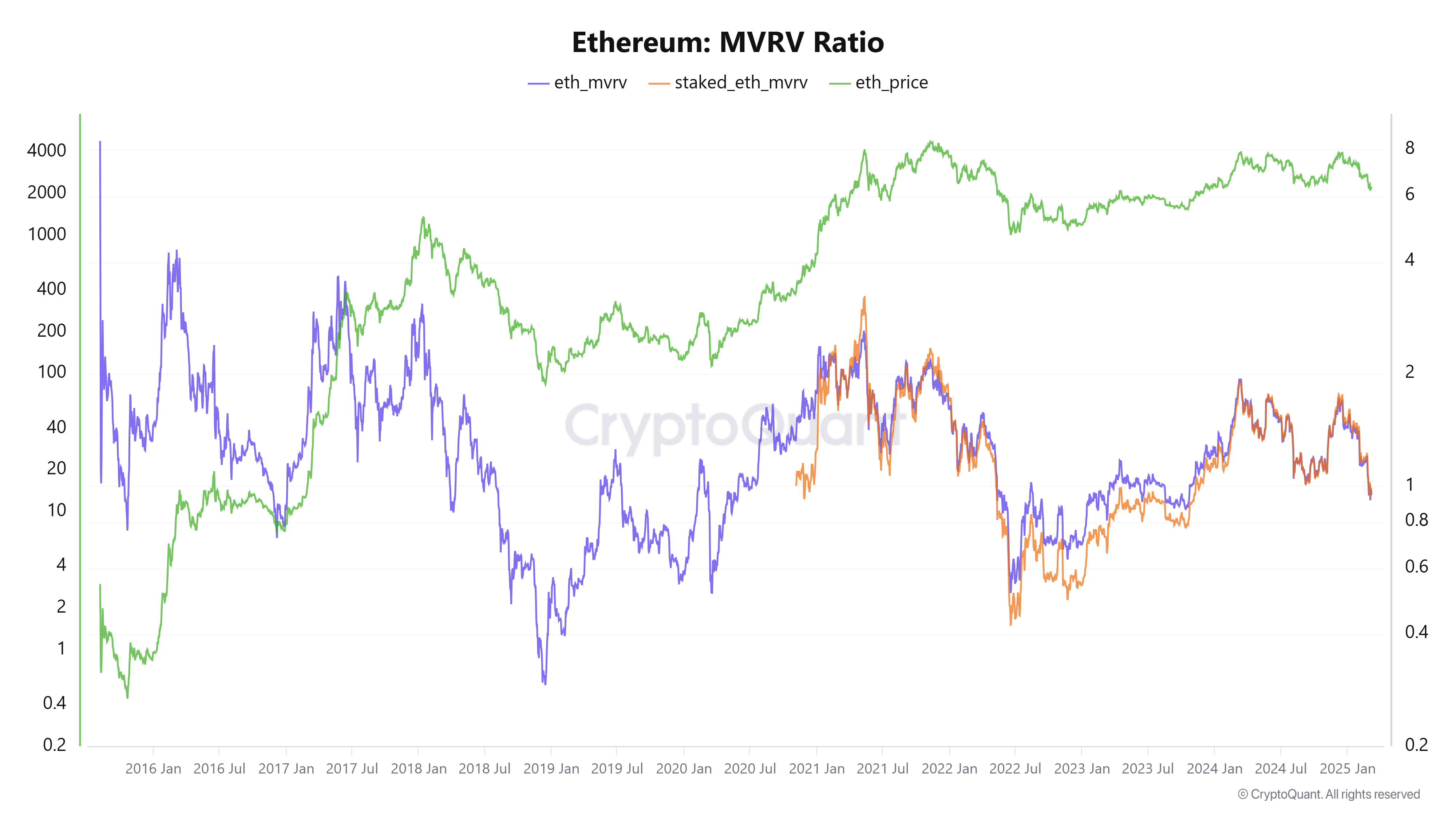

Ethereum’s Market Value to Realized Value (MVRV) ratio, which measures the average profit/loss of ETH investors, dropped below 1 following heightened bearish sentiment surrounding the crypto ecosystem. Historically, ETH has rallied after the MVRV crosses below 1 during bull seasons, indicating the top altcoin may soon see a recovery.

ETH MVRV. Source: CryptoQuant

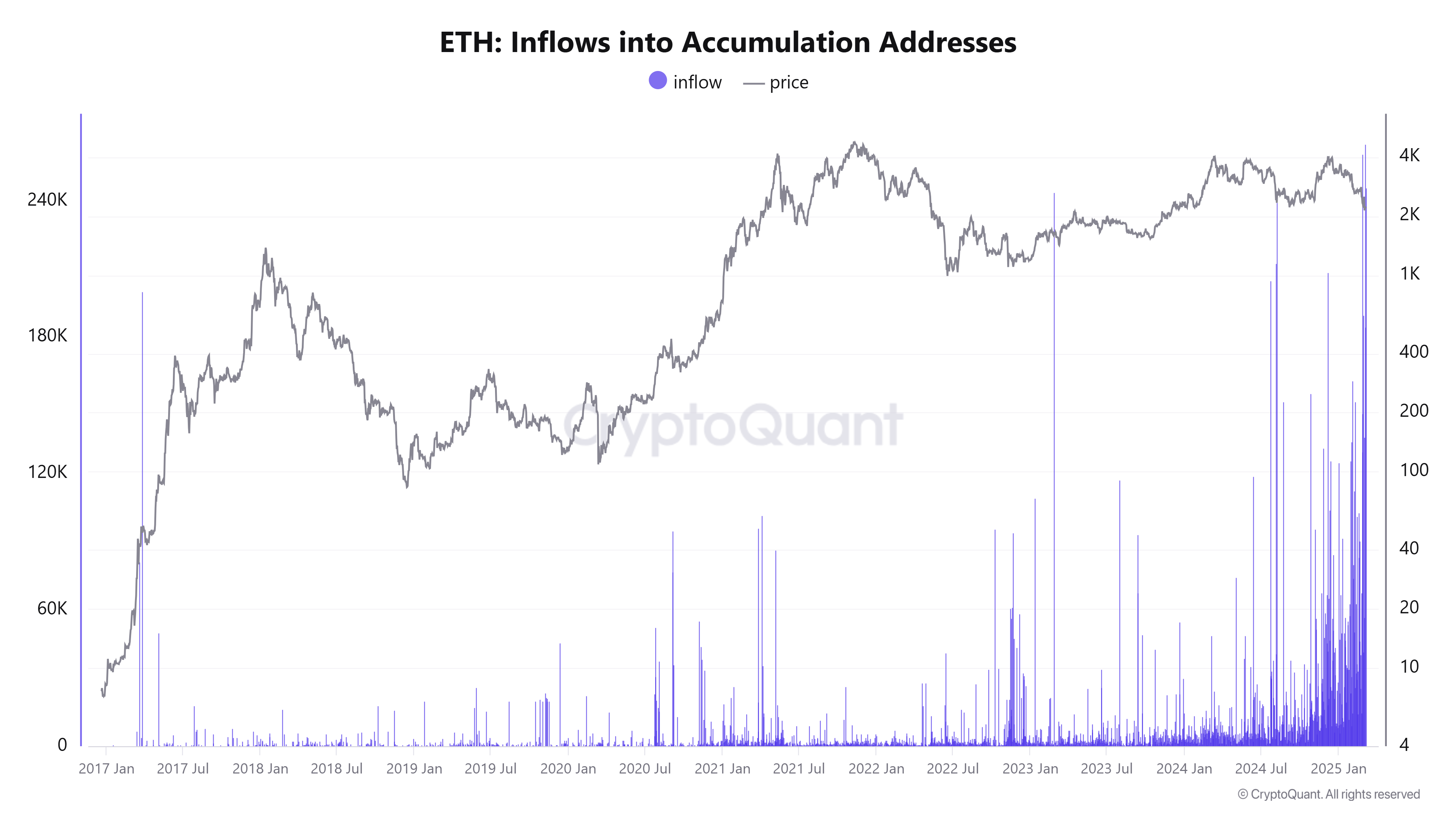

The ratio’s decline signals that ETH’s price has fallen near most investors’ average purchase price. This has prompted an increase in the amount of ETH in accumulation addresses, as evidenced by the spikes in the chart below.

ETH inflows into accumulation addresses. Source: CryptoQuant

“This demonstrates large-scale accumulation activities by institutional investors in the current undervalued zone where MVRV is 1,” noted CryptoQuant analyst MAC_D.

Ether’s weak price movement in the past few weeks partly stems from issues with the Pectra upgrade on Holesky and Sepolia testnets — an environment for testing blockchain features before deploying them on-chain.

Holesky failed to finalize due to configuration issues with execution layer clients, resulting in a temporal chain split. Sepolia also encountered its fair share of challenges, but developers quickly fixed them.

In its recent All Core Developers Consensus (ACDC) call, Ethereum developers agreed to launch a shadow Holesky fork to test features from the Pectra upgrade and to ensure Holesky is finalized before moving on with the mainnet upgrade.

The Pectra upgrade will bring several improvements to Ethereum, including account abstraction features like sponsored transactions, wallet recovery, payment of gas fees in ERC-20 tokens and transaction batching. Pectra will also expand the maximum staking limit per node from 32 ETH to 2,048 ETH, among other features.

Ethereum Price Forecast: ETH could fall to $1,500 if it fails to recover $2,200

Ethereum experienced $82.26 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions accounted for $55.28 million and $26.98 million, respectively.

ETH has been struggling to reclaim the $2,200 level since suffering a 15% decline on Monday. The $2,200 level marks the lower boundary of a key rectangular channel that ETH held for over four months following the market crash in August 2024.

ETH/USDT daily chart

If bulls fail to match the selling activity from bears and ETH continues to see a rejection at $2,200, it could decline toward the next key support at $1,500.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating dominant bearish momentum.

A daily candlestick close above $2,850 will invalidate the bearish thesis.