Gold near fresh all-time highs ahead of US trading session

- Gold price has a new all time high in reach on Monday after US yields drop off further.

- The German Far-Right AfD has gained 20% of votes, though not enough to keep the CDU out of a comfortable lead.

- US Dollar Index trades flat with US yields softening, room for Gold to tick higher.

Gold’s price (XAU/USD) is seeing gains tick up on Monday, trading near $2,952 at the time of writing, fueled by a weaker US Dollar (USD) and softening US yields in a reaction to the recent German federal election outcome. Although the far-right party Alternative for Germany (AfD) has gained 20% of votes, the Christian Democratic Union of Germany (CDU) is comfortable in the lead with 208 seats against AfD’s 152. US yields dropped off and the CME Federal Reserve (Fed) Futures are now favoring a 25 basis points (bps) rate cut in June, where last week odds were rather for no rate cut in June.

Meanwhile, traders will watch the US Gross Domestic Product (GBP) release for the fourth quarter of 2024 later this week. Given the recent slowdown in US activity and economic data (for example, the softer Services Purchase Managers Index (PMI) reading on Friday), another drop in US yields could be triggered, with markets anticipating the Federal Reserve lowering its monetary policy rate to boost the economy and demand.

Daily digest market movers: G7 tensions

- A current G7 meeting is close to failing to agree a joint statement that would mark the three year historic event since Russia’s invasion of Ukraine, due to disagreements between the US and its European allies.The US opposed to clauses that condemned Moscow and a call for more energy sanctions, and has threatened to pull support for a statement altogether, although discussions are ongoing.

- US Yields drop off further on Monday, with the US 10-year benchmark rate already down over 3% against the 4.573% high from last week. The CME Fed Futures for June revealed odds for a 25 basis points rate cut overtaking odds for no rate cut by 46.0% for a rate cut against 42.3% for no rate cut in the June 18th policy meeting.

- Canada’s Equinox Gold Corporation sought to acquire Calibre Mining in a deal that would value the combined companies at $5.4 billion. This is the latest example of dealmaking as miners capitalize on record gold prices, Bloomberg reports.

- The US dollar weakened after several reports and economic data points last week revealed that US business activity slowed and consumer confidence waned, with expectations for inflation surging and markets pricing in more rate cuts by the Federal Reserve this year, Bloomberg reports.

- Conservative CDU leader Friedrich Merz emerged as the winner in Sunday’s German federal election. However, the results gave his Christian Democrat-led bloc just one clear path to power, facing intense pressure to quickly form a government. While the far-right AfD doubled support to become the second-strongest party with 20.8% of the votes, it fell short of a blocking minority on its own, the Financial Times reports.

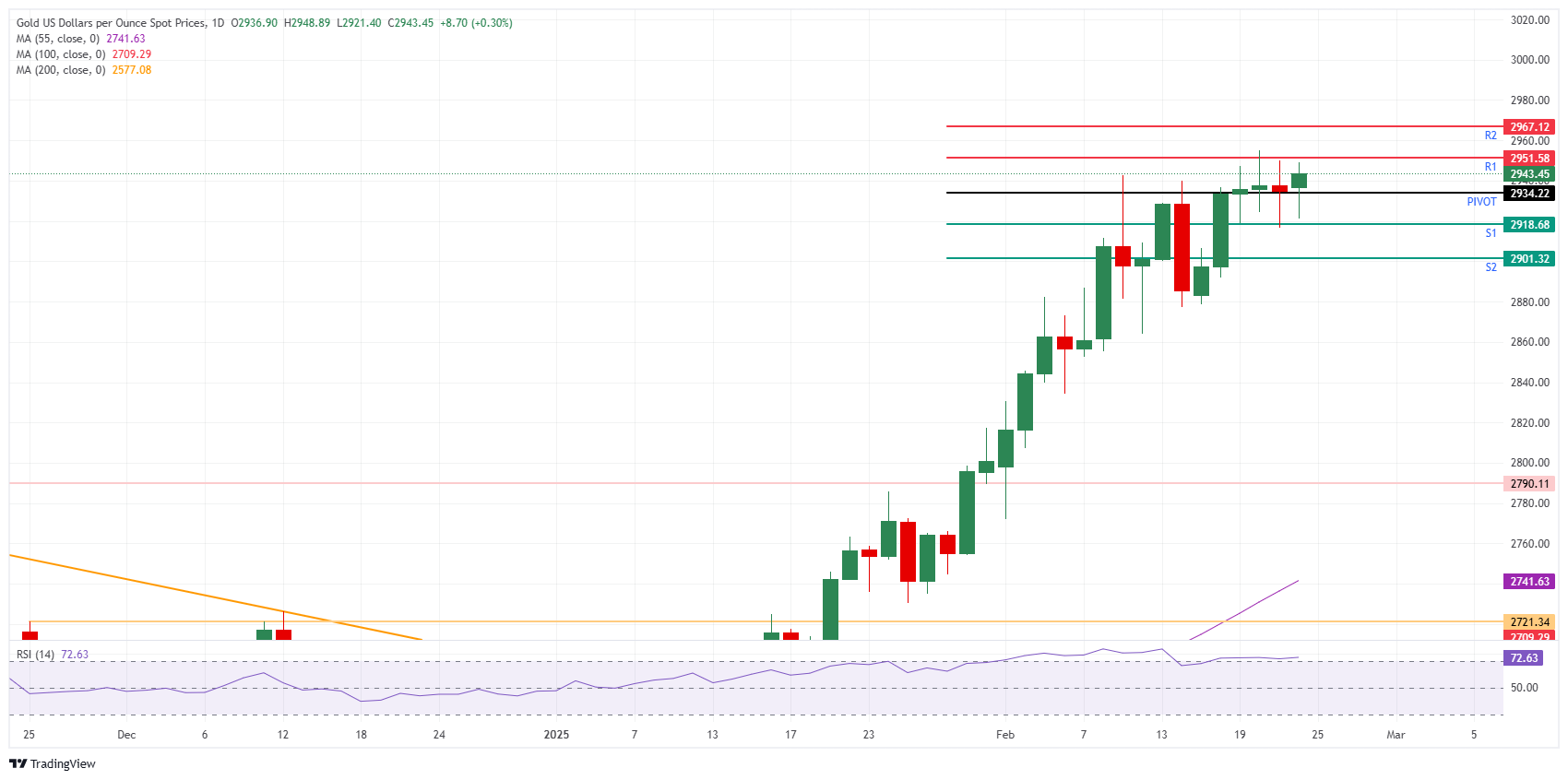

Technical Analysis: Almost there

Traders must be getting headaches from these constant whipsaw moves. With more and more banks calling for the $3,000 mark, the risk is building that the Gold price might not actually reach it. A similar story was seen in the Euro against the US Dollar (EUR/USD), where at one point this year all banks called for parity, though the pair never got there and instead moved higher.

For this Monday, the all-time high at $2,955 remains the main level to watch. On the way up, the daily R1 resistance at $2,951 precedes. Further up, meaning that there will be a new all-time high, the R2 resistance stands at $2,967.

On the downside, support levels are plentiful, with the daily Pivot Point at $2,934. Further down, the S1 support comes in at $2,918, which roughly coincides with Friday’s low. In case that level does not hold, the $2,900 big figure comes into play with the S2 support at $2,901.

XAU/USD: Daily Chart