Invest in the World’s Top Companies

Trade the world’s leading Stocks with Today Markets.com . Profit from even the smallest markets moves – CFDs are traded on margin, which enables you to multiply profits through the facility of leverage.

Remember this goes both ways though – where there is greater reward, there is greater risk too. Additionally, with Today Markets.com you can trade on both rising and falling markets, using leverage up to 50:1.

Why Choose Today Markets?

- Globally renowned broker, with strong track record since 2006

- Leverage of up to 50:1

- Access all major exchanges including NYSE, US Tech 100 & FTSE

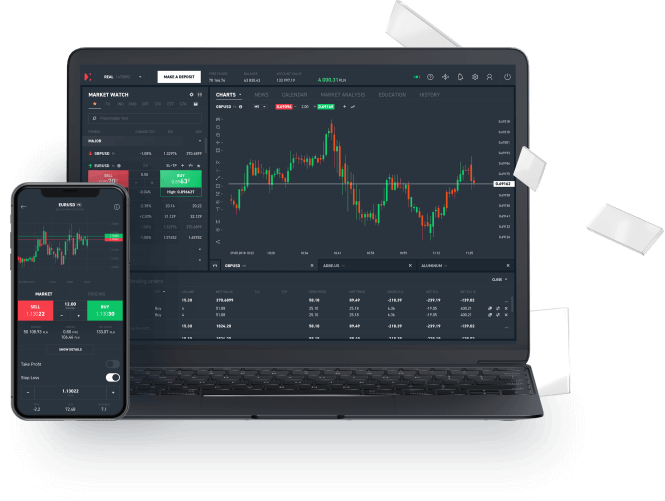

- Trade Stocks, Indices & Commodities from a single screen

- Live multilingual client support

- World-class educational tools and resources

- Multiple platforms: Desktop, Web and Mobile.

Trade Stocks CFDs

Stock CFDs (Contracts for Difference) have become increasingly popular over recent years.

When you enter into a CFD trade, you do it without actually taking ownership of the underlying asset. That means, that you won’t actually own the Facebook or Amazon Stock, for instance. Instead, you are speculating on the price movement of the Stock. Your reward then is the difference between the open price of the trade and the close price, minus the spread, which is the broker’s fee. This all brings a level of flexibility that the traditional Stock market often doesn’t.

Through CFDs you can open a SELL position just as easily as a BUY position, allowing you to take advantage of price movements in both rising and falling markets. For instance, you can hope to profit by buying LOW and selling HIGHER, with the difference in price being your reward. Alternatively, you can SELL high and then BUY lower later.

Remember that because you aren’t actually purchasing the underlying asset, you can trade with leverage, which allows you to take a large position with a small investment. But remember, leverage is considered a ‘double-edged sword’ because it increases both your rewards and also your risk.

Buy or Trade Stocks?

When looking to invest in Stocks, there are different options that the average investor has. First, there’s the route of directly buying Stocks from a Stock broker. Here, one could incur substantial fees and commissions for having the broker facilitate your trade. This old way of investing goes back to the days when we would place an actual phone call to execute a trade. Not to mention the fact that some shares are really expensive, so you will need a lot of capital behind you to get started and have any kind of reasonable level of exposure to the markets.

Today, we have online Stock trading. Here, traders enjoy direct, independent access to the same global Stocks via online brokers, allowing them to take advantage of reduced costs, even when considering a range of fees and commissions for their trading activities.

While the minimum trading requirement is reduced at some online brokers, the fee schedule is excessive, putting a strain on the investor’s profit/loss ratio. Beyond this, some online brokers only offer access to some markets, such as forex and Stocks. This could leave you somewhat limited in your trading choices especially if you prefer trading cryptocurrencies or commodities.

If you are tech savvy, you might have come across a wide range of investment apps. While these apps are convenient and bring Stock trading right into the palms of your hands, some of these apps only offer limited investment opportunities and are limited in their overall evaluation of your financial situation. Before one invests, it is always wise to evaluate a number of factors including your tax situation, any debts and other investments. This is where a regulated online broker takes centre stage.

On the whole, conventional Stock trading, involves a few pros and cons. On the one hand, there is the ability to earn dividends and to accumulate wealth with a solid financial instrument. On the other hand, panic selling during bear markets and the difficulty associated with short-selling, can put a damper on your investment goals.

Compare all of this with Stock CFD trading. This form of investing allows you to trade with leverage and preserve more of your trading capital for other opportunities. Beyond this, you can simply short sell any Stock without needing to borrow the shares as with the traditional route.

In addition, the only costs associated with stock CFD trading will be the bid/ask spread. This reduces the cost of Stock trading to minimum.

The ability to trade the world’s leading Stocks under these conditions is just one of the things that many retail investors have come to appreciate. By using trading as a way to express your opinion on the financial state of a company, you are able to do so without the hefty fees and/or other complications that may arise.

While you don’t take actual ownership of the underlying shares of the company, you do get to enjoy the most important thing that short-term and swing traders look for: the ability to pinpoint potentially lucrative trading opportunities and to profit from them.

White Label Solutions

White Label Solutions Execution

Execution PMAM Platform

PMAM Platform Partner Types

Partner Types Trading Signals

Trading Signals Charting Features

Charting Features Countdown Pricing

Countdown Pricing Wealth Management

Wealth Management Guardian Angel

Guardian Angel Vanilla Options

Vanilla Options