Trade of The Day – EUR/USD

- March 4, 2026

- Posted by: Today Markets

- Categories: Forex, Markets

Facts:

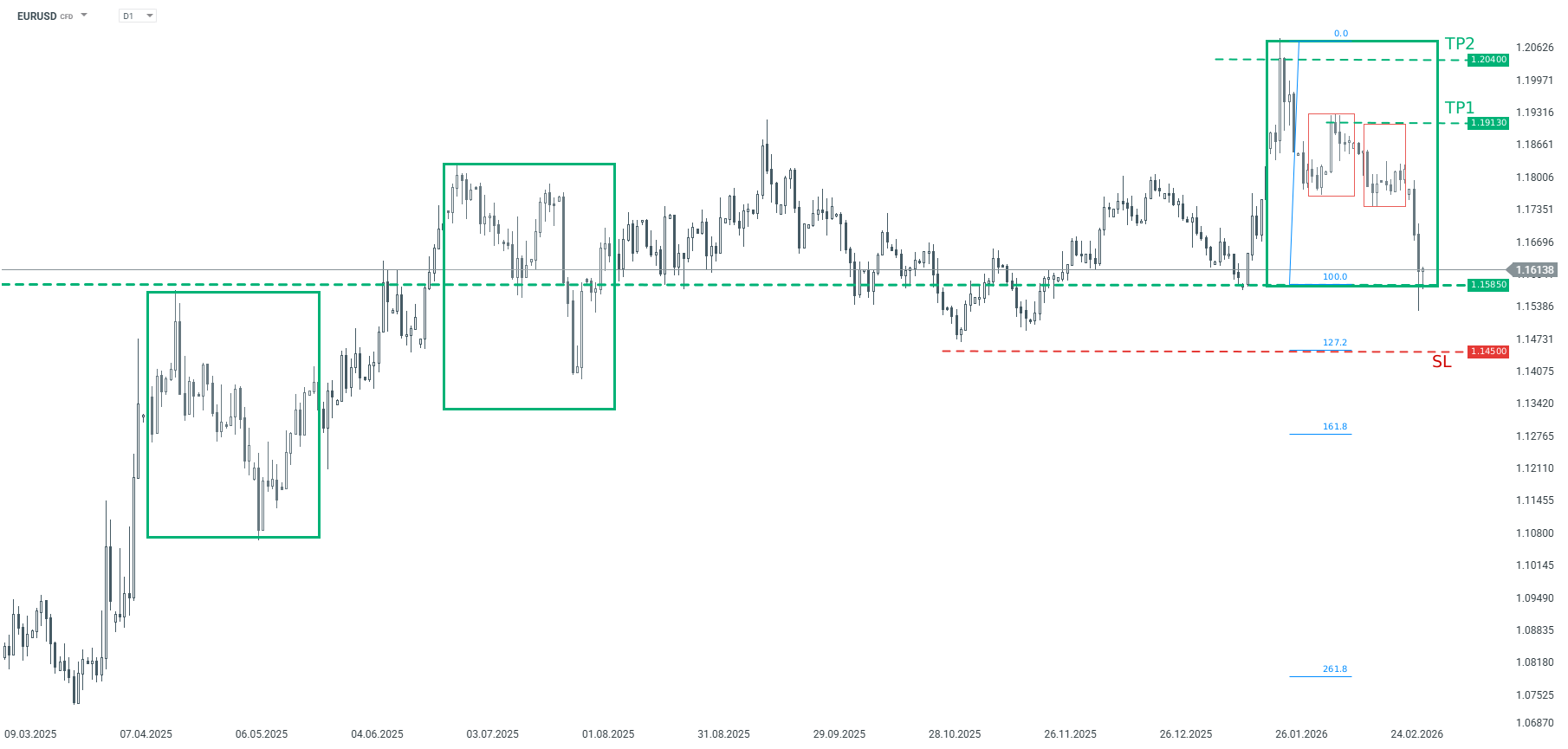

Long term sentiment on EURUSD from the beginning of 2025 remains bullish

The pair bounced off the horizontal support at 1.1585

Recommendation:

Trade: Long position on EURUSD at market price

Target: 1.1913, 1.2040

Stop: 1.1450

Opinion:

Looking at EURUSD at the D1 interval, we can see that the long-term sentiment on the pair has been bullish. However, a downward correction has occurred recently, which has brought the pair down to the key support at 1.1585 USD. The support is a result of previous low from 18th of January as well as lower limit of 1:1 structure. According to the Overbalance strategy, as long as the price sits above 1.1585 support, the main trend remains upward. We recommend going long EURUSD at market price with two targets: 1.1913 and 1.2040 We also recommend placing a stop loss order at 1.1450. Source: xStation5