Trading prices and execution

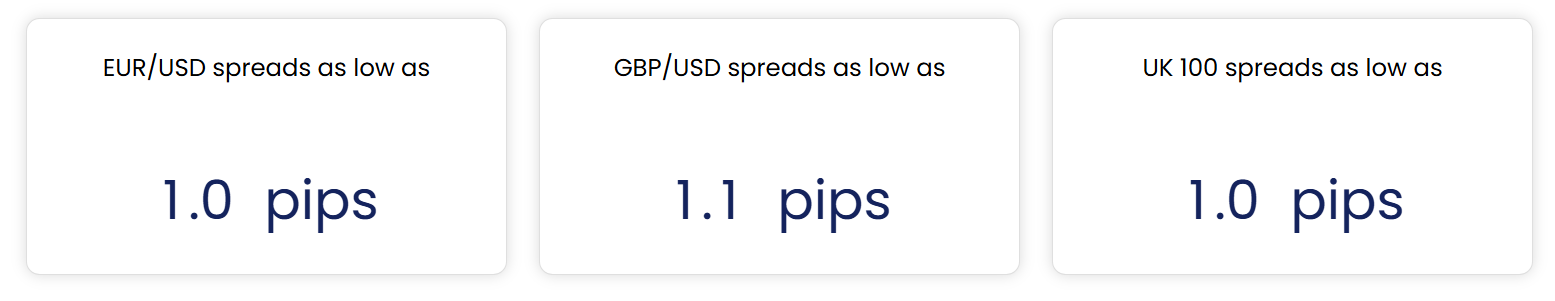

Tight spreads, transparent charges, and price improvement technology that may save you money.

Flexible account types to suit your trading style

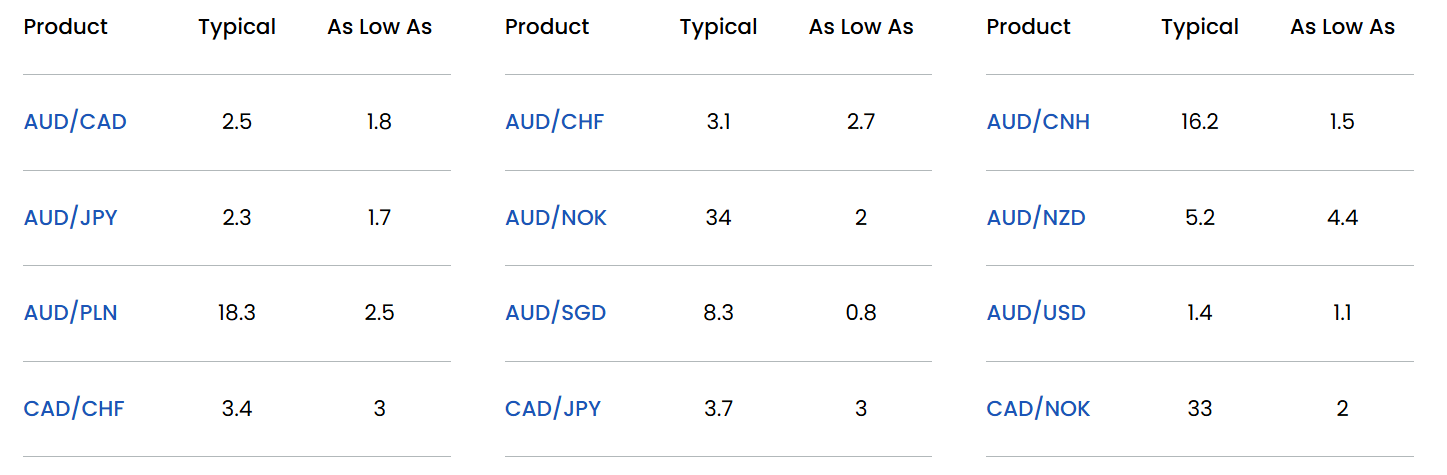

‘As low as’ pricing is based on most recently completed calendar month

During times of high volatility and/or low liquidity, spreads may be higher than the typical and as low as spreads published on the website

Standard spread pricing, no commissions

USD/RUB and EUR/RUB are currently unavailable for trading.

Spreads will vary based on market conditions, including volatility, available liquidity, and other factors. Typical spreads may not be available for Managed Accounts and accounts referred by an Introducing Broker. cTrader spreads may vary. The “Typical” spreads for pairs noted above represent the median spread available and the “As low as” spreads represent the minimum spread available during the previous full calendar month between the first and last trading day of that month. Refer to the last updated date to understand what month the data is representing.

Spreads and trade execution

Trade execution matters

Pricing means nothing without reliable, fast execution. We’re proud to be the only FX broker to share our record of success.*

Fast and accurate pricing - 100% of trades successfully executed

Your trades deserve the best execution in the market. Our hi-tech trading platforms consistently deliver fast and accurate pricing, so you can trade with confidence.

100% of trades executed in less than 1 second

We've automated every aspect of the trade process to ensure your trades are executed as fast as possible at the price you expect – or better.

1.03 pips average price improvement per limit order

When the market moves in your favor, our trading technology automatically passes along the savings by executing your trade at a better price.

*Includes all valid trade and orders requests, excluding those entered on the cTrader platform.

Refers to trade executions for Octalas Group Ltd. Please note that multiple factors may impact execution speed, including but not limited; market conditions, platform type, network connectivity, trading strategies, and account type. TodayMarkets.com’s execution statistics represent Octalas Group Ltd. orders executed on TodayMarketscom’s platforms during market hours September 30, 2025, 5:00 pm ET, and October 31, 2025, 5:00 pm ET and excludes trades/orders entered on the cTrader platform.

Market volatility, volume, and system availability may delay trade executions. Price can change quickly in fast market conditions, resulting in an execution price different from the price available at the time order is submitted. Price improvement is not guaranteed and will not occur in all situations.

Excludes trades that received non-standard order processing and orders that failed to trigger.

Forex rollover rates and overnight financing

We don’t apply rollover interest to intraday trades. Instead, we source institutional rollover rates and pass them to you at a competitive price.

That means, if you are a short-term trader, you can trade as much as you want, and not have to worry about earning or paying any rollover interest as long as you have no open trades at 5 PM ET.

Other brokers may calculate financing charges continuously and second by second, which could raise your trading costs when you trade intraday.

The benefits to you:

- You receive some of the most competitive rollover rates in the industry

- You don’t incur rollover at all on intraday trades

- You always know how much you’ll earn or pay; our rollover rates are posted every day and available within the trading platform

To find the rollover rate for a particular market, just log into our Web Trading platform and select your product’s “Market 360” to bring up the relevant pricing information.