Wheat is classified as a soft commodity

What is wheat trading?

Wheat trading is the act of speculating on the upward or downward price movements of wheat without taking actual ownership of the underlying commodity. You can trade upward and downward price movements.

Wheat is classified as a soft commodity because it’s a naturally occurring raw material that’s grown, harvested and processed for human consumption. This is unlike hard commodities, which are mined or extracted from the earth and used in manufacturing.

Commodities are mass-produced and the pricing is standardised – meaning it remains the same the world over. Like all other stocks, commodities are bought and sold over dedicated exchanges.

The only difference, however, is that commodities can be bought and sold at current or future prices – a key factor to consider for traders who want to add wheat to their portfolios. Other factors that could have an impact on wheat prices include breaking news or political events, seasonal cycles and weather.

How to trade or invest in wheat

There are a few ways you can start trading or investing in wheat with us. CFDs are a popular choice if you’re looking for leveraged, short-term exposure to wheat price movements without taking ownership of the underlying asset. You can trade wheat on the spot, or get exposure via futures or options.

Wheat futures

Wheat futures are contracts that enable traders to place leveraged trades on the commodity for a fixed price at a pre-determined date in the future.

By entering into the contract, both the buyer and seller are obligated to either buy or sell on or before its expiry date.

Wheat options

Wheat options are contracts that give you the flexibility to trade wheat without the obligation to buy or sell at the underlying asset at a set price within a set timeframe. With CFDs, you can gain exposure to wheat prices while paying zero commission.

Is wheat a good investment?

Wheat commodities remain a popular investment, especially in times of economic and market uncertainty, where they’re seen as an inflation hedge against the US dollar, as they’re priced in USD. So, if dollar performance weakens, inflation often rises, which boosts wheat prices.

For investors looking to diversify, wheat commodities are also a common breakaway from the ‘traditional’ company stocks and bonds.1

Grain markets, a growing performance?

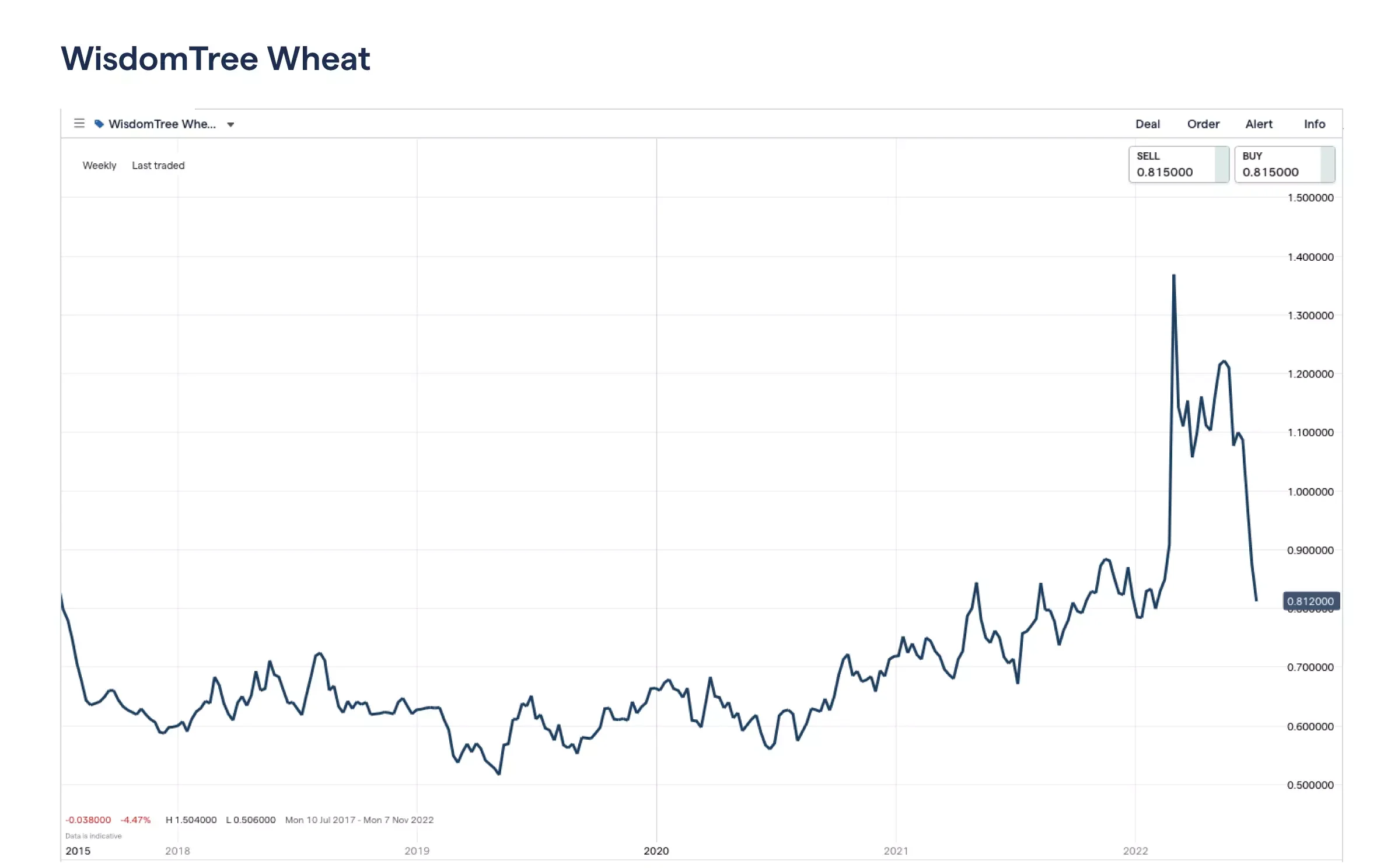

Although the Russia-Ukraine conflict’s caused turmoil to global markets, wheat commodities, in particular, took a hard hit. This is because both Russia and Ukraine (who account for close to a third of all global exports) seized production, sparking fear of possible food shortage.

Despite the chaos caused by the conflict, demand for wheat is predicted to increase over the years. This is due to its diverse use as a source of food for both human and animal consumption, as well as the ease with which it grows, compared to other grains.2

While wheat commodity prices may have dropped sharply over recent months, they still remain 30% higher than before the Russian conflict put a halt to most European exports. Although the discord’s caused great disruption to European exports, it’s opened up opportunities for other emerging markets like India, whose pricing is seen as more competitive than the current high global prices caused by the current shortage.

Wheat trading and investing summed up

- Wheat trading involves speculating on the price of wheat without taking actual ownership of the underlying asset or commodity

- In times of economic or market uncertainty, wheat commodities are a good hedge against a weak dollar

- The demand for wheat commodities is predicted to increase over the years

- There are a few ways to trade or invest in wheat with us, for example CFD trading and stock trading

Contact us at the Today Market office nearest to you or submit a business inquiry online.