Foreign exchange, also known as forex or FX, is the exchange of different currencies on a decentralised global market. It’s one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world’s currencies on this market.

Foreign exchange rates between different currency pairs show the rates at which one currency will be exchanged for another. It plays a vital role in foreign trade and business as products or services bought in a foreign country must be paid for using that country’s currency. You can trade currency pairs through a forex spread betting or CFD trading account.

Forex trading explained

Forex is one of the most widely traded markets in the world, with a total daily average turnover reported to exceed $5 trillion a day. The forex market is not based in a central location or exchange, and is open 24 hours a day from Sunday night through to Friday night. A wide range of currencies are constantly being exchanged as individuals, companies and organisations conduct global business and attempt to take advantage of rate fluctuations.

How does forex trading work?

Forex is always traded in currency pairs – for example, GBP/USD (sterling v US dollar). You speculate on whether the price of one country’s currency will rise or fall against the currency of another country, and take a position accordingly. Looking at the GBP/USD currency pair, the first currency (GBP) is called the ‘base currency’ and the second currency (USD) is known as the ‘counter currency’.

When trading forex, you speculate on whether the price of the base currency will rise or fall against the counter currency. So in GBP/USD if you think GBP will rise against USD, you go long (buy) the currency pair. Alternatively, if you think GBP will fall against USD (or that USD will rise against GBP), you go short (sell) the currency pair. Find out what are the most traded currency pairs in the forex market here.

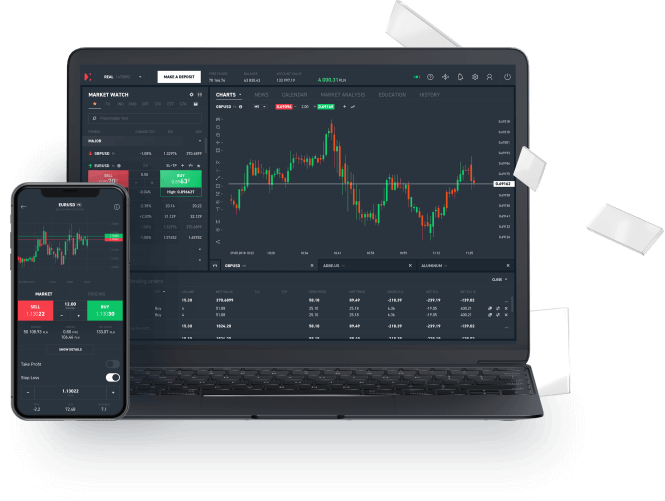

Forex traders can access the market, either trading from home or on-the-go, thanks to advances in desktop and mobile technology. Read more about how to start forex trading from home here.

Free demo account

Practise trading risk-free with virtual funds on our Next Generation platform.

Currency strength indicators

It’s important to remember when looking at forex that a stronger currency makes a country’s exports more expensive for other countries, while making imports cheaper. A weaker currency makes exports cheaper and imports more expensive, so foreign exchange rates play a significant part in determining the trading relationship between two countries.

What causes one currency in a forex pair to strengthen?

There are a variety of factors at play in this relationship and they all contribute in some way to whether the strength of a currency declines or improves in relation to another. Understanding the influencing factors gives traders insights they can incorporate into their forex trading strategies, including day trading, swing trading and forex scalping strategies.

Some of these factors include political stability, interest rates, inflation, terms of trade, public debt and current account deficits. For example, in the case of interest rates, if rates are higher, lenders get a better return compared to those in a country with lower rates; therefore the higher rates attract foreign capital which causes the exchange rate to rise. This is one of the reasons forex traders may look to trade on interest rate announcements from central banks like the US Federal Reserve or the Bank of England.

What causes one currency in a forex pair to decline?

The factors mentioned above can also cause a currency to decline. For example, the currency of a country with low inflation will generally rise because that country’s purchasing power is higher relative to other currencies. Even natural disasters such as earthquakes or tsunamis, which put a strain on a nation’s economy, can have a negative impact on a currency.

Political instability and poor economic performance can also have a negative impact on a currency, such as when there are political elections and national recessions. Politically stable countries with robust economic performance will always be more appealing to foreign investors, so these countries will draw investment away from countries characterised by more economic or political risk. Furthermore, a country showing a sharp decline in economic performance will experience a loss of confidence in its currency and a movement of capital to currencies of more economically steady countries. These are just two simple examples of what can affect foreign exchange rates and the kind of things traders consider when developing forex trading strategies.

What are the benefits of forex trading?

Some of the main benefits of forex trading that make this asset class a popular choice among traders are:

- The ability to trade on margin (using leverage)

- High levels of liquidity mean spreads stay tight which keeps trading costs low

- Prices react quickly to breaking news and economic announcements (this can be a disadvantage too)

- Trade 24 hours a day from Sunday to Friday

- The ability to go long and short

- Wide range of markets (spread bet or trade CFDs on over 300 forex pairs with CMC Markets)

What are the potential risks of forex trading?

Some of the possible risks involved in forex trading are:

- You can lose all of your capital – leveraged forex trading means that both profits and losses are based on the full value of the position. Our accounts offer competitive margin rates on forex instruments starting at just 3.3%, or 30:1 leverage, which is higher leverage than the 20% margin rate (5:1 leverage) available for shares instruments. Read more about forex vs stocks here.

- Risk of account close out – market volatility and rapid changes in price can cause the balance of your account to change quickly, and if you do not have sufficient funds in your account to cover these situations, there is a risk that your positions will be automatically closed by the platform

- Market volatility and gapping – financial markets may fluctuate rapidly and gapping is a risk that arises as a result of market volatility, and one of the effects of this may mean that stop-loss orders are executed at unfavourable prices

Bottom line

Forex or currency trading is a fast-paced, exciting option and some traders will focus solely on trading this asset class. They may even choose to specialise in just a few select currency pairs, investing a lot of time in understanding the numerous economic and political factors that move those currencies.

Still want to learn more about forex trading? Check out our forex trading for beginners’ guide, which includes a step-by-step guide on how to start forex trading.

White Label Solutions

White Label Solutions Execution

Execution PMAM Platform

PMAM Platform Partner Types

Partner Types Trading Signals

Trading Signals Charting Features

Charting Features Countdown Pricing

Countdown Pricing Wealth Management

Wealth Management Guardian Angel

Guardian Angel Vanilla Options

Vanilla Options